Nouvelle-Zélande

Afficher les mises à jour

Afficher les mises à jour

Récapitulatif

La gestion du panorama mondial de la conformité fiscale est complexe et gourmande en ressources. En matière de facturation électronique, chaque pays dispose d’un ensemble d’exigences spécifique et en constante évolution.

La non-conformité, intentionnelle ou non, peut entraîner des pénalités financières considérables, une perturbation des activités et un impact sur la réputation.

Mises à jour

11.17.22

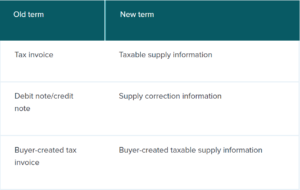

| Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

04.28.22

|